colorado estate tax exemption 2021

175 for Applications for. Colorado estate tax exemption 2021 Sunday February 13 2022 Edit.

Colorado Democrats Look To Ax Tax Breaks For Wealthy And Corporations

For property tax years commencing on and after January 1 2021 the bill increases from 200000 to 300000 the maximum amount of actual value of the owner-occupied primary.

. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. Instructions and FAQs Annual Reports for Exempt Property Schools.

The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. Application for Property Tax Exemption.

Ad Download Or Email Form 104 More Fillable Forms Try for Free Now. For the 2021 tax year Colorado has a flat income tax rate of 45. To the Department to request.

There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. The 2021 2022 data gathering period is July 1 2018 through June 30 2020. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

Threshold Factor History 2009-2021 Tax Incentives and Exemptions. The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000. If the return is filed on paper the total.

All renewable energy property in Colorado is taxable unless specifically exempted under Colorado law. Under the new law those wealthier households cant subtract more than 60000 from their taxable income. Larimer County Assessor Bob Overbeck said the Colorado Legislature has again funded the two programs.

0803 2022 The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000 General Election. The Colorado constitution allows a veteran who has a service-connected disability rated as a 100 permanent disability to claim a property tax exemption for 50 of the first 200000 of. However a lease for a term of 36 months or less is tax-exempt if the lessor has paid Colorado sales or use tax on the acquisition of the leased property.

Even though there is no. In 2000 Colorado voters amended the state constitution creating a property tax exemption for seniors. The change to itemized deductions is expected to be one of the.

There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the. When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. Sep 28 2021 Legislative Resources.

Residential Properties Specific Forms For Charitable-Residential Properties. For those who qualify for the exemptions 50 of the first 200000 in actual value. Timely filings with a 75 filing fee per report are due by April 15.

Petition for Abatement or Refund of Taxes PDF 72KB To appeal property values and to abate refund taxes for the immediate two prior years through the Board of County Commissioners. Property taxes in Colorado are definitely on the low. Ad Register and Subscribe Now to Work on Form 104 More Fillable Forms.

Wednesday 22 June 2022. It was lowered from 455 to 45 because of a high fiscal year revenue growth rate. Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

To qualify for this exemption.

State And Local Tax Advisor June 2021 Our Insights Plante Moran

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Death And Taxes Nebraska S Inheritance Tax

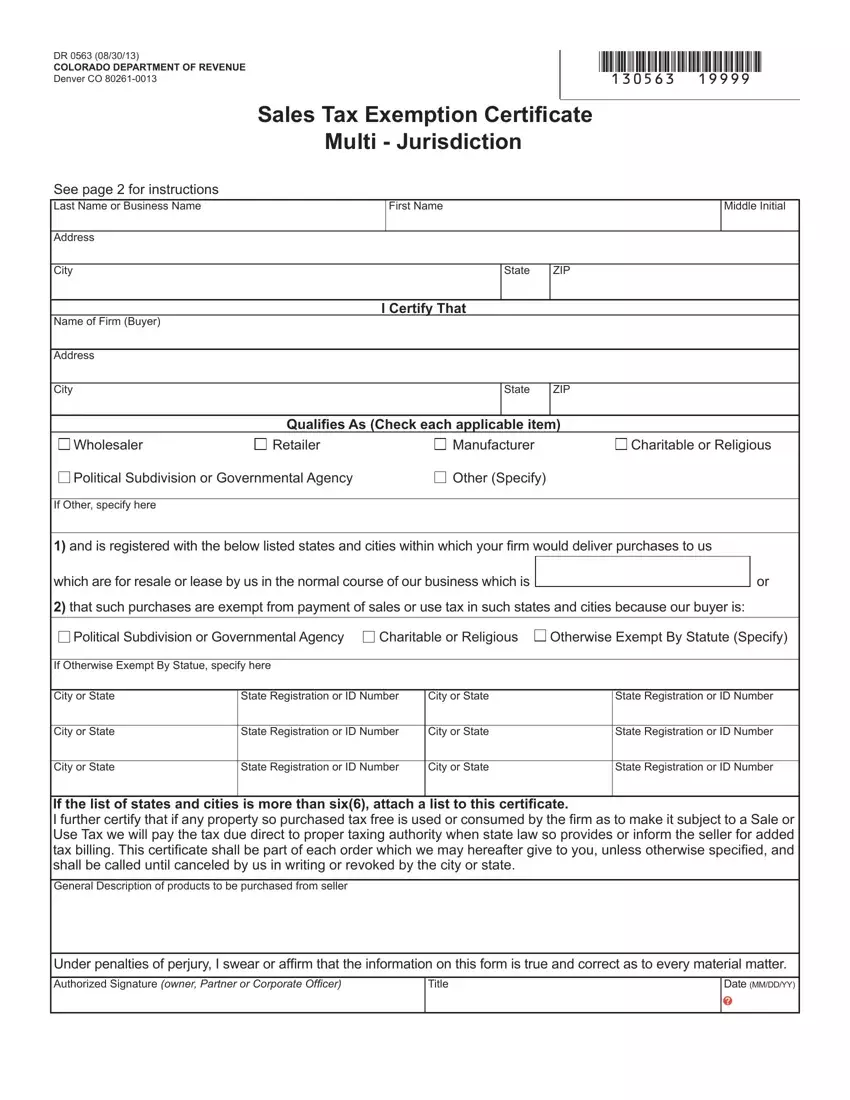

Colorado Exemption Form Fill Out Printable Pdf Forms Online

State By State Estate And Inheritance Tax Rates Everplans

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

State And Local Tax Advisor September 2021 Our Insights Plante Moran

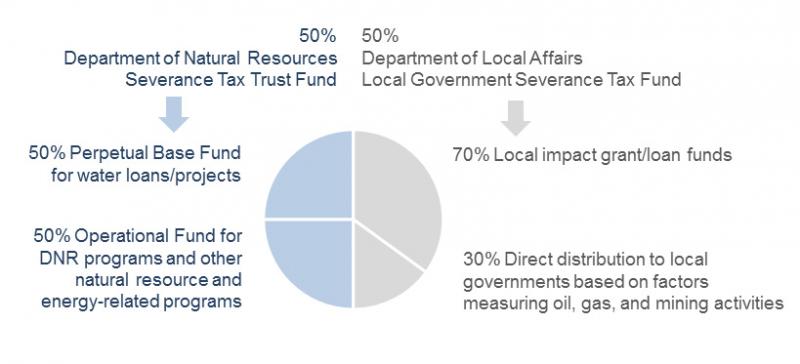

Severance Tax Colorado General Assembly

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Taxation Of Trust Capital Gains Douglas A Turner P C

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Individual Income Tax Colorado General Assembly

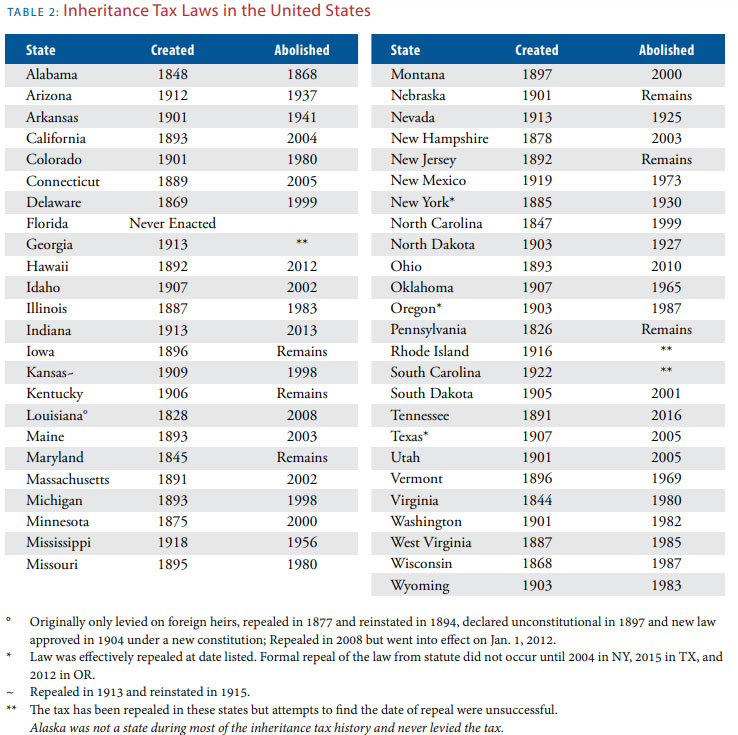

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

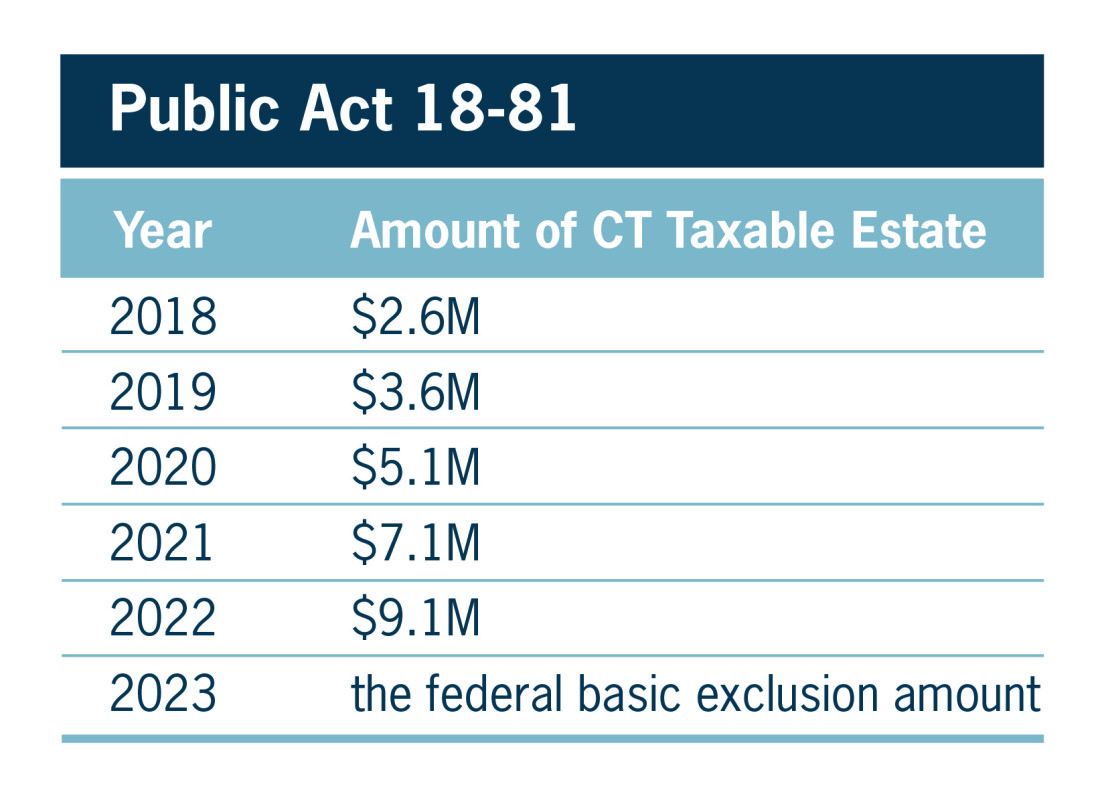

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra